GRAFTECH INTERNATIONAL (EAF)·Q4 2025 Earnings Summary

GrafTech Plunges 18% as Q4 Revenue Misses by $24M Amid Pricing Collapse

February 6, 2026 · by Fintool AI Agent

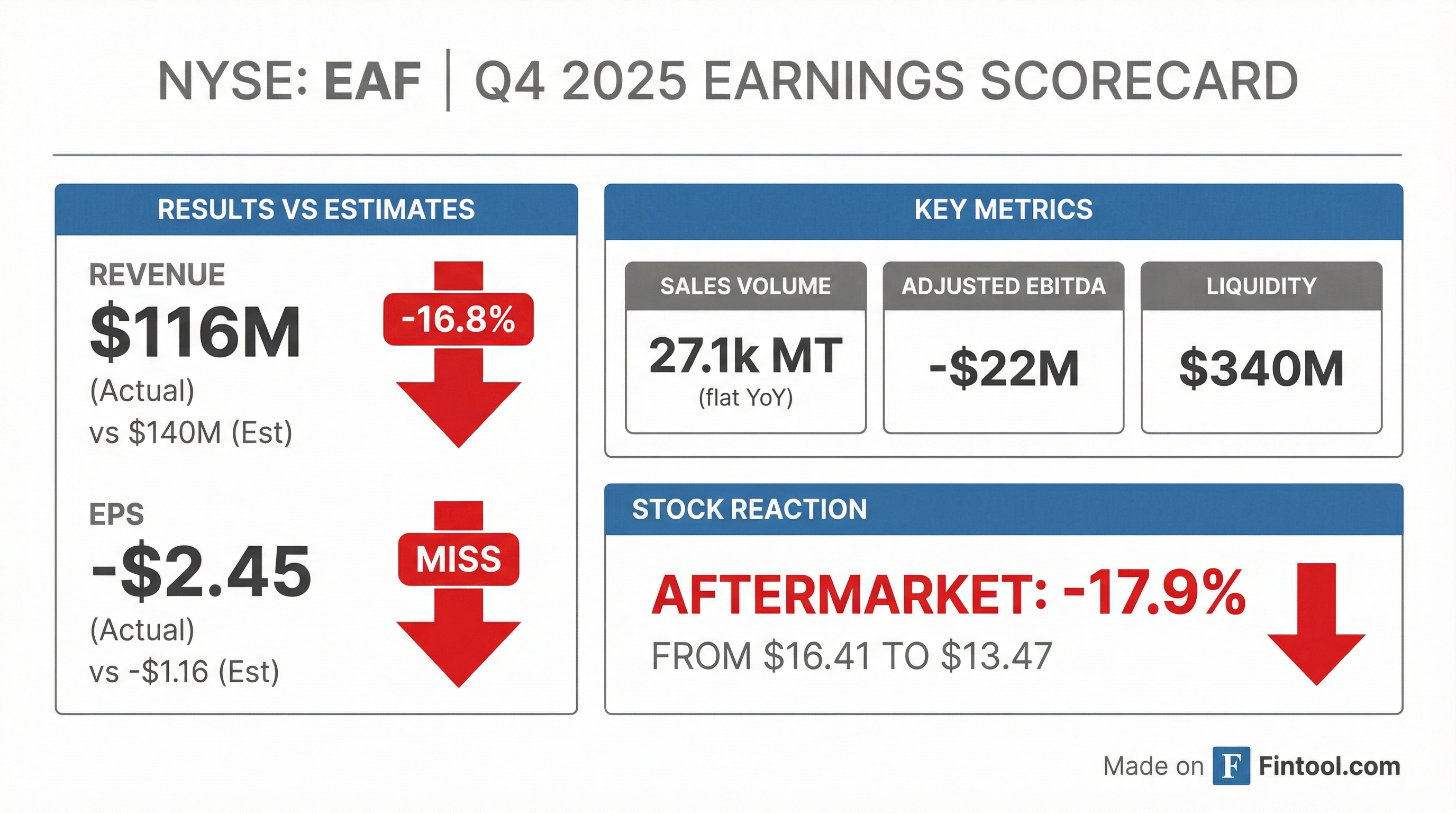

GrafTech International (NYSE: EAF) reported a challenging Q4 2025, missing revenue estimates by 16.8% as pricing for graphite electrodes continued to deteriorate. The graphite electrode manufacturer posted revenue of $116.5M versus consensus of $140M, with adjusted EPS of -$2.45 versus expectations of -$1.16. The stock plummeted 18% in aftermarket trading to $13.47.

Did GrafTech Beat Earnings?

No. GrafTech missed on both top and bottom lines by wide margins.

The miss was driven by persistent pricing pressure across all commercial regions. Weighted-average realized price dropped to approximately $4,000 per MT, down 9% year-over-year and 5% sequentially from Q3 2025.

What Did Management Guide?

Management provided cautious guidance for 2026, acknowledging that pricing pressures will persist:

Volume Guidance:

- FY 2026 sales volume: +5-10% YoY growth

- Q1 2026 sales volume: +10% YoY

- Approximately 65% of 2026 volume already committed in order book

Cost Guidance:

- Cash cost of goods sold per MT: Low single-digit decline expected in 2026

- Cumulative cost reduction since 2023: 31%

- 2026 capex: ~$35M

Pricing Warning: CEO Timothy Flanagan stated that "industry-wide pricing levels remain unsustainably low" and that "challenging pricing dynamics, most notably aggressive competitor pricing behavior, increased further during Q4 2025" and are expected to continue into 2026.

How Did the Stock React?

GrafTech shares plunged 17.9% in aftermarket trading.

The sharp decline reflects investor concern over the sustainability of the business model given persistent pricing weakness and continued operating losses.

What Changed From Last Quarter?

The quarter included a $12M non-cash LCM inventory valuation adjustment that pressured Adjusted EBITDA.

Key deterioration: While Q3 showed signs of margin stabilization with positive Adjusted EBITDA, Q4 saw a sharp reversal driven by lower realized prices and the inventory write-down.

Key Operating Metrics

Geographic mix shift: U.S. sales volume grew 83% YoY in Q4 2025 and 48% for the full year, as management actively shifted volume to higher-priced regions. U.S. shipments represented 31% of FY 2025 sales volume versus 22% in the prior year. The higher U.S. mix boosted weighted-average selling price by nearly $200/MT in Q4 and $135/MT for the full year.

Capital Structure and Liquidity

Key concern: Cash burn accelerated significantly in 2025. Adjusted free cash flow was -$115M for FY 2025 vs -$56M in FY 2024. The company has no major debt maturities until December 2029.

Full Year 2025 Summary

FY 2025 sales volume came in below guidance of +8-10% YoY, as management chose to forego volume opportunities "where margins would be unacceptably low."

Operational highlight: GrafTech achieved a Total Recordable Incident Rate (TRIR) of 0.41 in 2025, representing its best safety performance on record.

CEO Commentary

Timothy Flanagan, CEO, highlighted both accomplishments and challenges:

"Looking back on 2025, I am proud of how our team navigated a challenging environment with discipline and determination. We achieved notable successes, including a 6% increase in our full-year sales volume despite a flat demand environment globally, led by 48% sales volume growth in the United States."

On the competitive environment:

"Competitive pricing pressures for graphite electrodes have intensified further of late, a dynamic that is neither sustainable for the graphite electrode industry nor supportive of the long-term health of the steel industry. A resilient steel sector depends on a strong graphite electrode industry with the ability to invest and grow alongside it."

On pricing discipline:

"We at GrafTech refuse to follow some of our competitors in the race to the bottom. While this meant that our full-year volume finished below our most recent guidance range, it was the right decision for our business and consistent with our commitment to value-focused growth, not volume for volume's sake."

Industry Outlook

Global Steel Production (2025):

- Global (ex-China) steel production: 843 million tons (+<1% YoY)

- U.S. steel production: +3% YoY

- EU steel production: -3% YoY (down 15% from 2021 highs)

- Global capacity utilization: ~67% (EU at just over 60%)

World Steel 2026 Demand Outlook:

- Global (ex-China): +3.5% YoY

- U.S.: +1.8% YoY

- EU: +3.2% YoY

Near-term headwinds:

- China steel exports hit record highs in 2025, constraining global production

- Geopolitical uncertainty impacting steel industry trends

- Supply side remains "structurally out of balance"

Potential tailwinds:

- Global (ex-China) graphite electrode demand expected to increase slightly in 2026

- U.S. steel production expected to rise with favorable domestic trade policies

- EU Carbon Border Adjustment Mechanism (CBAM) implemented January 2026, plus new trade protections later in 2026

- Hot-rolled coil steel pricing expected to increase in most regions

- Over 20 million tons of new EAF capacity either recently online or planned in the U.S.

Long-term thesis: EAF steelmaking accounted for 51% of steel production outside China in 2024, continuing steady share gains. Management remains confident that steel decarbonization via electric arc furnace adoption will drive long-term graphite electrode demand growth.

Q&A Highlights

On Competitor Pricing Behavior:

Analyst Bennett Moore (JPM) pressed on whether aggressive pricing has worsened, particularly in the U.S. CEO Tim Flanagan responded firmly:

"The level of pricing that people are quoting and behaving within the market doesn't reflect the asset-intensive nature of our business. It doesn't incentivize R&D spending, and it really doesn't allow for adequate returns to be generated for shareholders. So, that's what we're seeing in the market, and I think that's problematic as we look out into the future."

He added that pricing pressure is global, not region-specific, driven by material being "dumped into the market" from China and India.

On Winning Market Share:

Analyst Arun Viswanathan (RBC) questioned how GrafTech can win back share if competitors are pricing irrationally. Flanagan emphasized the value proposition:

"As the pure play electrode player outside India and China, we focus a lot of time on R&D, bringing new products. We spend a lot of money and effort on our customer technical service teams... and really look to partner with our customers and add value to their furnaces and their steelmaking processes."

On Pivoting to EV Battery Materials:

Flanagan confirmed heightened focus on anode materials for the EV/energy storage market:

"There's a heightened focus on every element of our business, both our core business of producing and selling graphite electrodes, but also how we can become a more significant player in the establishment of supply chains outside of China for anode material."

He noted GrafTech would likely pursue partnerships rather than standalone investments given capital constraints. The anti-dumping case against Chinese graphite anode material is expected to finalize in March 2026.

On Indian Tariff Changes:

Analyst Abe Landa (BofA) asked about the impact of Indian tariffs being reduced from 50% to 18%. Flanagan noted:

"We think that the repealing of the 50% tariff against the Indians down to 18% is probably a step too far... But quality carries the day and service carries the day, and we think that's what differentiates GrafTech from some of the competitors in the marketplace."

On China Overcapacity:

Flanagan provided color on China's export impact:

"The Chinese continue to export at increasing levels on an annual basis... They're over 300,000 tons of total exports... and probably represent maybe a third of the non-Chinese market right now in terms of total demand."

China has ~800,000 tons of electrode capacity supporting only ~90 million tons of EAF steel production domestically, leaving massive excess for exports.

Key Risks Flagged

- Pricing sustainability: Current pricing levels are "unsustainably low" per management

- Cash burn: Accelerating cash consumption with -$115M adjusted FCF in 2025

- Balance sheet stress: Stockholders' deficit widened to -$260M

- Deferred tax valuation allowance: $43M non-cash charge in FY 2025 related to full valuation allowance against U.S. and Switzerland deferred tax assets

Strategic Priorities for 2026

Management outlined several strategic priorities and options being evaluated:

- Manufacturing footprint optimization — Evaluating additional capacity rationalization

- Trade/policy advocacy — Pursuing support on multiple fronts, including synthetic graphite classification as critical mineral

- Strategic partnerships — Exploring partnerships for anode material supply chains (EV/energy storage)

- Alternative capital sources — Evaluating options to enhance liquidity and flexibility

On potential capacity cuts industry-wide, Flanagan noted: "At some point in time, that logjam or that capacity surplus has got to come offline. People will start to make decisions based on that."

Forward Catalysts

- Q1 2026 earnings (expected May 2026): Will reveal if pricing stabilizes

- Anti-dumping case finalization (March 2026): Tariffs on Chinese graphite anode material could support domestic supply chains

- Trade policy developments: U.S. tariff decisions could support domestic pricing

- EU safeguard measures: Additional protection for European steelmakers expected later in 2026

- Steel demand recovery: Improvement in global steel production would boost electrode demand

Related: GrafTech Company Profile | Q3 2025 Earnings | Latest Filings